Russian Stock Market

Russian Stock Market is one of the most volatile in the world. The market is highly dependent on oil prices, and when oil prices are high, the Russian stock market tends to be strong. However, when oil prices are low, the Russian stock market tends to decline. In addition, political instability in Russia can also lead to volatility in the stock market.

The Russian stock market is one of the most important in the world. It is made up of a number of exchanges, including the Moscow Exchange and the Saint Petersburg Stock Exchange. The market capitalization of the Russian stock market was estimated to be $1.3 trillion as of September 2017.

The Russian stock market is dominated by a few large companies. The largest company on the Moscow Exchange is Gazprom, which has a market capitalization of $52.7 billion. Other large companies include Rosneft, Sberbank, Lukoil, and VTB Bank.

The Russian stock market has been volatile in recent years. In 2014, the market crashed after Russia’s annexation of Crimea and the subsequent sanctions from Western countries. The market rebounded in 2015 and 2016, but declined again in 2017 due to low oil prices and geopolitical tensions.

The Russian stock market is a mix of state-owned and privately-owned companies. The largest company on the Russian stock market is Gazprom, which is state-owned. Other large state-owned companies include Rosneft and Sberbank. There are also many privately-owned companies on the Russian stock market, including Lukoil, Norilsk Nickel, and Severstal.

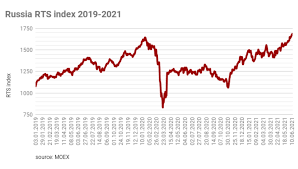

The Russian stock market has been quite volatile in recent years. The RTS Index, which tracks the performance of the Russian stock market, dropped by more than 60% between 2007 and 2009. However, it has since recovered and has been rising steadily in recent years. In 2017, the RTS Index reached an all-time high of 2,445 points.

Russia Stock Market

Russia’s stock market was among the world’s worst performers in 2015. The Micex Index, which tracks stocks traded on the Moscow Exchange, fell by more than 50% last year. This was due in part to the sharp decline in oil prices and Western sanctions imposed on Russia over its role in the Ukraine crisis.

However, things may be starting to look up for Russian stocks. The Micex Index is up by more than 20% so far in 2016, thanks to a stabilization in oil prices and a weakening of the U.S. dollar. Some analysts are even predicting that Russian stocks could be one of the best performers this year.

There are still some risks associated with investing in Russia, including political uncertainty and strict capital controls. But if you’re looking for exposure to some of the world’s fastest-growing economies, Russian stocks may be worth considering.

The RSM is one of the world’s ten largest, with a market capitalization of over $1.2 trillion as of January 2018. The market is highly concentrated, with the ten largest companies accounting for more than three-quarters of the total market capitalization.

The RSM has been among the best-performing markets in the world in recent years. The RTS Index, which tracks the performance of leading Russian stocks, surged more than 125% in 2017, making it one of the world’s top-performing stock markets.

Investors have been attracted to Russian stocks by Russia’s strong economic growth and high dividend yields. The country’s economy is expected to grow by 2.5% in 2018, while dividends paid by Russian companies are among the highest in the world.

The Russia stock market has been on the rise in recent years. This is largely due to the fact that the country has become more open to foreign investment. In addition, the Russian government has made a number of reforms to improve the business climate in the country. These reforms include reducing regulation and improving infrastructure. As a result, foreign investors are now more interested in investing in Russian companies. The Russia stock market is also becoming more liquid, which means that investors can buy and sell stocks more easily. This makes the market more attractive to investors and helps to spur economic growth. We continue to produce content for you. You can search through the Google search engine.