Decentralized Finance

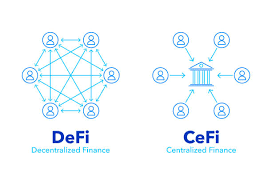

Decentralized Finance In a decentralized financial system, there is no one authority that centrally controls the flow of money. Instead, the network of participants in the system work together to manage the flow of money according to pre-determined rules. This allows for a more efficient and secure system than traditional financial systems.

One advantage of a decentralized financial system is that it is more resilient to attacks. Because there is no central authority, there is no single point of failure that can be exploited. This makes it difficult for attackers to disrupt the system or steal funds.

Decentralized finance also enables new types of financial applications that are not possible with traditional systems. For example, applications that allow for peer-to-peer payments or decentralized exchanges can be built on top of a decentralized financial network. This allows for greater flexibility and innovation in the financial sector.

What is decentralized finance? Simply put, it is the use of blockchain technology to create a more efficient and democratized financial system. Decentralized finance allows for the removal of intermediaries such as banks and other financial institutions, resulting in a faster, more secure, and cheaper system.

One of the primary benefits of decentralized finance is its security. Because all transactions are recorded on a public blockchain, they are immutable and cannot be altered or tampered with. This eliminates the risk of fraud or corruption.

Another advantage of decentralized finance is its speed. Transactions can be completed in seconds or minutes rather than days or weeks. This makes it ideal for small businesses and entrepreneurs who need to move money quickly and efficiently. Finally, decentralized finance is much cheaper than traditional banking systems.

In an age when technology has pervaded every aspect of our lives, it’s no surprise that the financial sector is getting a makeover. Traditional banking and investment processes are being replaced by new, more efficient models that run on blockchain technology. Decentralized finance (DeFi) is a term used to describe this new wave of financial applications that operate without a central authority.

DeFi platforms allow users to borrow, lend, or trade digital assets in a trustless environment. This means that there is no need for a third party to mediate the transaction. Transactions are verified and recorded on a public ledger, so they can’t be tampered with. DeFi platforms also offer increased security and transparency when compared to traditional banking systems. The most popular DeFi application is cryptocurrency exchanges.

What İs Decentralized Finance

Decentralized finance (DeFi) is a term used to describe financial applications and platforms that are decentralized. This means that they are built on top of a blockchain or other distributed ledger technology and do not rely on a third party to store or manage user data. DeFi applications include peer-to-peer lending, decentralized exchanges, and tokenized assets.

One of the key benefits of DeFi platforms is that they are trustless. This means that users do not have to worry about the security of their data or funds, as these are stored in a secure blockchain network. DeFi platforms also tend to be more efficient than traditional financial applications, as they do not require intermediaries such as banks or payment processors. As a result, DeFi has the potential to revolutionize the global financial system.

Decentralized finance, or DeFi for short, is a term used to describe financial applications that are built on top of a decentralized infrastructure. This includes applications such as decentralized exchanges, peer-to-peer lending platforms, and asset management tools.

One of the key benefits of DeFi applications is that they are trustless. This means that users do not need to trust any third-party with their funds. Instead, all transactions are verified by the blockchain network.

DeFi also allows users to interact with each other without the need for middlemen. For example, on a decentralized exchange, users can trade tokens directly with each other without having to go through an intermediary. This helps to reduce costs and speeds up the trading process.

What is decentralized finance? Decentralized finance (DeFi) is an umbrella term for financial applications that run on a decentralized network. This includes applications such as decentralized exchanges, lending platforms, and stablecoins. DeFi has seen significant growth in recent years, with over $1 billion worth of value locked in DeFi applications as of January 2020. We continue to produce content for you. You can search through the Google search engine.